Build and enhance your network to the crypto community at CAC24A in April.

Join the Crypto Assets Conference, which takes place on the Frankfurt School of Finance & Management campus on April 16.

Discover recent developments: Blockchain, crypto assets, DeFi and funds at CAC24A in April.

Join the Crypto Assets Conference, which takes place on the Frankfurt School of Finance & Management campus on April 16.

Connecting the traditional finance industry with technology experts of the crypto scene at the best blockchain conference in Germany.

Join the Crypto Assets Conference, which takes place on the Frankfurt School of Finance & Management campus on April 16.

CAC24A on April 16, 2024

At Frankfurt School of Finance & Management

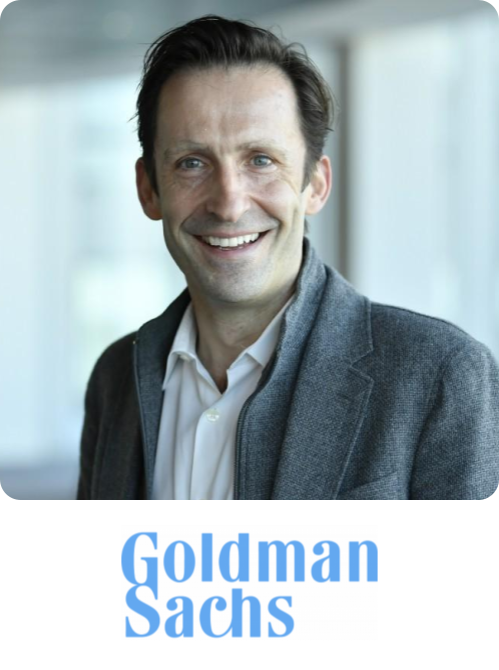

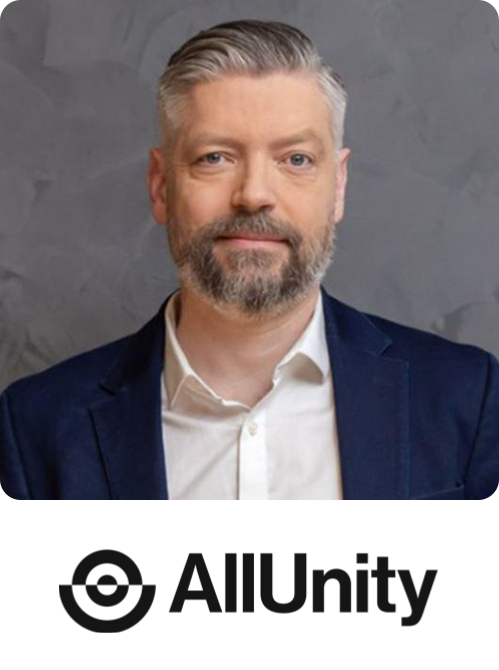

CAC24A SPEAKERS AND SPONSORS

"The Frankfurt School Blockchain Center is an extremely highly regarded center of competence for all topics around Token Economy and Digital Assets - not only here in Germany, but with a global outreach. Its Crypto Assets Conference is a fantastic opportunity, bringing FinTechs and TradFis together to share valuable content, discuss innovative ideas and network with great people. For sure we as Union Investment will join the March 2023 event."

"The Crypto Assets Conference has become over the last years the leading digital assets conference of the financial industry in the DACH region and beyond. Fintechs, banks, asset managers, consultants and corporates cover in insightful panel discussions and presentations the latest regulation, exciting use cases on tokenization and provide updates on CBDC projects."

"The Crypto Assets Conference stands out in the landscape of Web3 events. What makes it special is the right participation mix of institutions and native Web3 companies.This leads to great discussions and networking that drive real-world adoption. It is also a yearly showcase of the advancements in the European digital asset industry."

"The Crypto Assets Conference is a true hotspot for blockchain and crypto enthusiasts in Germany. This industry is so fast paced that it is crucial to have regular personal interaction with the key players and there is no better place than CAC. I appreciate the high level of expertise, the top-notch quality of the panels, as well as the fruitful exchange with industry experts on the pulse of time and always on top of the newest topics in the market."

ABOUT CAC

In the dynamic landscape of digital currencies, where Bitcoin and Ethereum challenge traditional monetary constructs and the integration of DeFi into mainstream banking becomes an inescapable reality, we're witnessing the transformation of the digital assets realm in ways never seen before. With the power of Web3 poised to reshape societal engagements and tokenization, redefining our perception of ownership, the applications of blockchain technology are broader and more varied than ever. More and more, incumbent industries are adapting to these developments, making a future devoid of digital assets an unimaginable concept.

Bringing together sector specialists, corporate visionaries, and innovative entrepreneurs, the Crypto Assets Conference in Frankfurt (#CAC24A) will once again take place on April 16, 2024 to explore the most current trends in DLT, blockchain, and crypto assets. Be part of an exclusive gathering with 450 on-site and more than 4,000 online participants at one of Europe's premier digital assets conferences, where the latest innovations and emerging industry trends are examined through insightful talks, interactive debates, and presentations by industry thought leaders.

As a hybrid event, all #CAC24A sessions will be live-streamed for our online participants, with on-site attendees having the opportunity to network with our wide range of partners, experts, and fellow attendees. Check out the recordings of our previous conferences and listen to panel discussions, presentations and more!

Day 1: Digital Assets

Digital Securities, Tokenization, Digital Funds,

Digital Finance, Infrastructure, Custody

Digital Assets:

The world of digital assets and its potential in present and future

Digital Securities:

Digital bonds, digital funds, digital shares, DLT Pilot Regime, eWpG

Tokenization of Assets:

MiCA regulation, real estate, music rights, luxury goods, vintage cars

Infrastructure:

Secure IT, custody services, service providers

Day 2: Crypto Assets & Web3

Bitcoin, ETPs, ETFs, DeFi, Web3,

Carbon Tokenization (CO2), ESG

Bitcoin:

Potential for an asset as scarce as gold

Securitized Tokens:

Bitcoin ETFs, token certificates, crypto indices

Ethereum, Stablecoins,

Smart Contract Platforms, DeFi:

The emergence of a new financial infrastructure

Web3, Metaverse, NFTs, Carbon Tokens:

The disruptive potential of the decentralized world; Emergence of virtual worlds in the Metaverse

Our CAC24A agenda

Our recordings of CAC23B

BRINGING TOGETHER EXPERTS FROM THE CRYPTO AND FINANCIAL WORLD TO ANSWER YOUR QUESTIONS

Bitcoin, Ethereum and other crypto assets

What is the state of worldwide adoption of Bitcoin and Ethereum? Will the Bitcoin and Ethereum predominance prevail? What about next-gen developments such as Ethereum scalability solutions, or Lightning and Taproot for Bitcoin?

Decentralized finance (DeFi)

What will be DeFi’s impact on traditional capital markets? Which protocols should be regarded? Do we witness the emergence of the future capital market? How can it be regulated?

Tokenization of assets

How can real assets be tokenized? How can securities, equity, debt and other assets be plugged into tokens? What developments have occurred concerning primary markets and secondary markets?

Investors and venture capital

What technical domains and business models are VCs focusing on? Are tokens an alternative to traditional VC investments?

Digital securities

How does a future dematerialization of securities affect the capital market? Is blockchain technology the appropriate technical basis for the realization of digital securities?

Stablecoins and digital euro

What are use cases for stablecoins? Which stablecoins projects exist besides Circle and Tether? What are the implications of a digital euro for the German and European economy? How could an implementation of a programmable, digital euro look like?

Regulatory developments

What are implications for MiCA, eWPG, etc.? Will the developments in the crypto market be accelerated or slowed down by the current regulatory impulses? What appropriate laws and safeguards must be implemented?

Custody of digital assets

How should digital assets be custodied in the best possible way? Which crypto custody service providers do exist? How do traditional financial institutions view the advance of crypto custody regulation and what does this mean for the adoption of crypto assets?

NFT and the Metaverse

Which use cases for NFTs are sustainable? When will the Metaverse emerge and how will it be used? How will digital identities be managed in virtual worlds?

CO2 offsetting

How can blockchain technology help with offsetting of carbon emissions? Which approaches exist to tokenize CO2? What platforms exist to issue CO2 tokens and trade them?

ESG and sustainability

Which use cases exist for ESG and sustainability? To improve financial inclusion, how can crypto assets and smart contract platforms such as Ethereum be leveraged? How can education in the crypto domain be improved?

Our Media & Network Partner

Use Thrilld to connect with other CAC24A participants!

Thrilld is a business app that allows Web3 projects, professional investors, developers, and Web3 service providers to find each other and talk synergies in a streamlined manner.

Networking, Matchmaking and Engagement

Thrilld functions as a full-fledged Web3 event networking tool and is the official networking app of the CAC24A, hereby enabling all conference attendees to find each other before, during, and after the event.

Find Information about the CAC24A

Attendees can not only connect with other participants but also find the agenda, side events, and additional information about the conference in the Thrilld app.

Stay in touch!

IMPRESSIONS FROM THE LAST YEARS

Crypto Assets Conference - Aftermovie

Enjoy some impressions of CAC22B in our official aftermovie

Panel Discussion - CAC23B

From Pilot to Issuance and Scalability of Digital Securities

DATE & VENUE

Frankfurt School Blockchain Center organizes the "Crypto Assets Conference" (CAC24A), held on the Frankfurt School campus on April 16, 2024.

60322 Frankfurt am Main

Germany

-2.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(1)-2.jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(6).jpg)

.png?width=499&height=670&name=Vorlage_Speaker%20Cards%20(3).png)

-3.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(1)-3.jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(10).jpg)

-2.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(7)-2.jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(11)-1.jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(11).jpg)

.png?width=499&height=670&name=CAC24A_Speaker%20Cards%20(3).png)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(13).jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(2)-1.jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(7).jpg)

-2.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(3)-2.jpg)

-2.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(6)-2.jpg)

.png?width=499&height=670&name=CAC24A_Speaker%20Cards%20(4).png)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(12).jpg)

.png?width=499&height=670&name=CAC24A_Speaker%20Cards%20(1).png)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(15).jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(14)-1.jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(2).jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(3).jpg)

-2.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(4)-2.jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(13)-1.jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(16).jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(18).jpg)

-4.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(1)-4.jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(17).jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(1)-1.jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(5)-1.jpg)

.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(8).jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(12)-1.jpg)

-2.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(9)-2.jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(10)-1.jpg)

-1.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(9)-1.jpg)

-2.jpg?width=499&height=670&name=CAC24A_Speaker%20Cards%20(8)-2.jpg)

-5.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-5.png)

-2-1.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-2-1.png)

-7.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-7.png)

-8.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-8.png)

-12.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-12.png)

-Sep-13-2023-09-03-39-1211-AM.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-Sep-13-2023-09-03-39-1211-AM.png)

-3-Sep-28-2023-07-18-15-8513-PM.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-3-Sep-28-2023-07-18-15-8513-PM.png)

-4-2.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-4-2.png)

-2-Oct-05-2023-12-59-26-9351-PM.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-2-Oct-05-2023-12-59-26-9351-PM.png)

-Sep-20-2023-06-27-45-9657-AM.png?width=550&height=150&name=Vorlage_Logos%20(Sponsor_Media)-Sep-20-2023-06-27-45-9657-AM.png)